볼린저밴드

def bollinger_band(data, w = 20, k = 2):

data = data.copy()

mbb = data['close'].rolling(w).mean()

ubb = mbb + k * data['close'].rolling(w).std()

lbb = mbb - k * data['close'].rolling(w).std()

data['width'] = ubb - lbb

# 볼린저 밴드에서 종가 위치

data['bollinger_band'] = (data['close'] - lbb) / data['width']

# 볼린저 밴드 넓이 증가량

data['bollinger_band_ratio'] = np.zeros(len(data))

data.loc[1:, 'bollinger_band_ratio']= (data['width'][1:].values - data['width'][:-1].values) / data['width'][:-1].values

data.drop(['width'], axis = 1, inplace = True)

return dataMACD

def cal_MACD(data, num_long=12, num_short=26, num_signal=9):

data = data.copy()

ema_long = data['close'].ewm(span=num_long, min_periods=num_long - 1).mean()

ema_short = data['close'].ewm(span=num_short, min_periods=num_short - 1).mean()

MACD = ema_long - ema_short

MACD_signal = MACD.ewm(span=num_signal, min_periods=num_signal - 1).mean()

data['MACD_diff'] = MACD - MACD_signal

# MACD cross

data['MACD_cross'] = pd.Series(np.where(data['MACD_diff'] >= 0, 1, -1), index=data.index)

# 지난 MACD 대비 MACD 비율

data['MACD_lastMACD_ratio'] = np.zeros(len(data))

data.loc[1:, 'MACD_lastMACD_ratio'] = (data['MACD_diff'][1:].values - data['MACD_diff'][:-1].values) / data[

'MACD_diff'][

:-1].values

data.drop('MACD_diff', axis=1, inplace=True)

return dataRSI

def cal_RSI(data, period = 9):

data = data.copy()

U = np.where(data['close'].diff(1) > 0, data['close'].diff(1), 0)

D = np.where(data['close'].diff(1) < 0, data['close'].diff(1) * (-1), 0)

AU = pd.Series(U, index = data.index).rolling(window=period, min_periods=period).mean()

AD = pd.Series(D, index = data.index).rolling(window=period, min_periods=period).mean()

RS = AU / AD

data['RSI'] = 1 - 1 / (1 + RS)

return dataStochastic Oscilator

def cal_stochastic_oscillator(data, n = 5):

data = data.copy()

size = len(data)

temp=[]

for i in range(size):

if i >= n-1:

tempUp = data['close'][i] - min(data['low'][i-n+1:i+1])

tempDown = max(data['high'][i-n+1:i+1]) - min(data['low'][i-n+1:i+1])

if tempDown == 0:

tempDown = 0.001

temp.append(tempUp / tempDown)

else:

temp.append(0) #n보다 작은 초기값은 0 설정

data['sto_K'] = pd.Series(temp, index=data.index)

data['sto_D'] = data['sto_K'].rolling(3).mean()

return data

OBV

def cal_OBV(data, n=9):

data = data.copy()

OBV = []

OBV.append(data['volume'][0])

for i in range(1, len(data)):

if data['close'][i] > data['close'][i - 1]:

OBV.append(OBV[-1] + data['volume'][i])

elif data['close'][i] < data['close'][i - 1]:

OBV.append(OBV[-1] - data['volume'][i])

else:

OBV.append(OBV[-1])

OBV = pd.Series(OBV, index=data.index)

data['OBV_ewm'] = OBV.ewm(n).mean()

# OBV signal

data['OBV_cross'] = pd.Series(np.where(OBV >= data['OBV_ewm'], 1,-1), index = data.index)

# 지난 OBV_ewm 대비 OBV_ewm 비율

data['OBV_lastOBV_ratio'] = np.zeros(len(data))

data.loc[1:, 'OBV_lastOBV_ratio'] = (data['OBV_ewm'][1:].values - data['OBV_ewm'][:-1].values) / data['OBV_ewm'][

:-1].values

data.drop('OBV_ewm', axis=1, inplace=True)

return data

Log Return

def cal_log_return(data):

data = data.copy()

data['log_return'] = np.zeros(len(data))

data['log_return'] = np.log(data['close'] / data['close'].shift(1))

return data

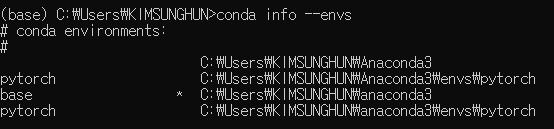

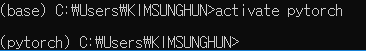

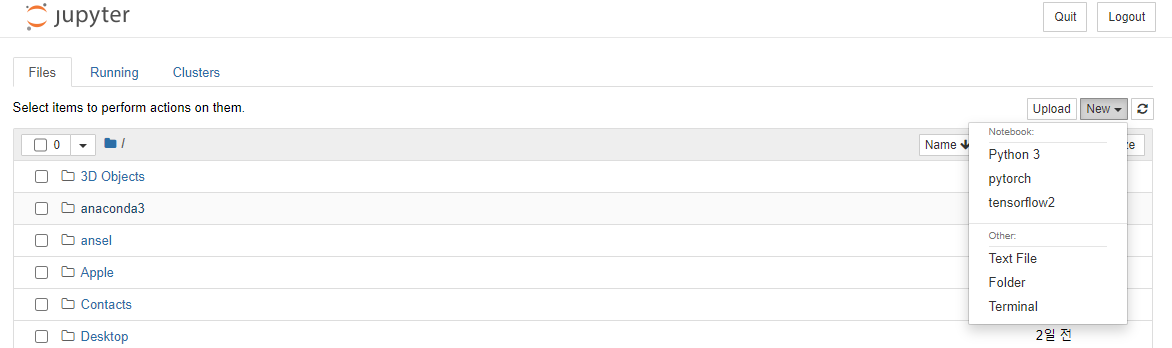

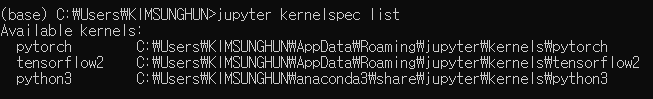

'기타' 카테고리의 다른 글

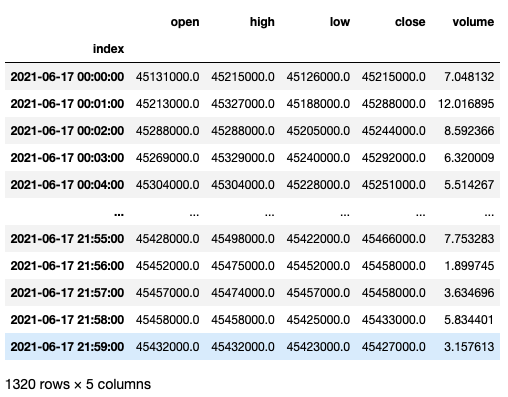

| 비트코인 분봉 데이터 가져오기 (0) | 2021.06.17 |

|---|---|

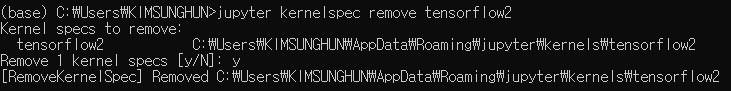

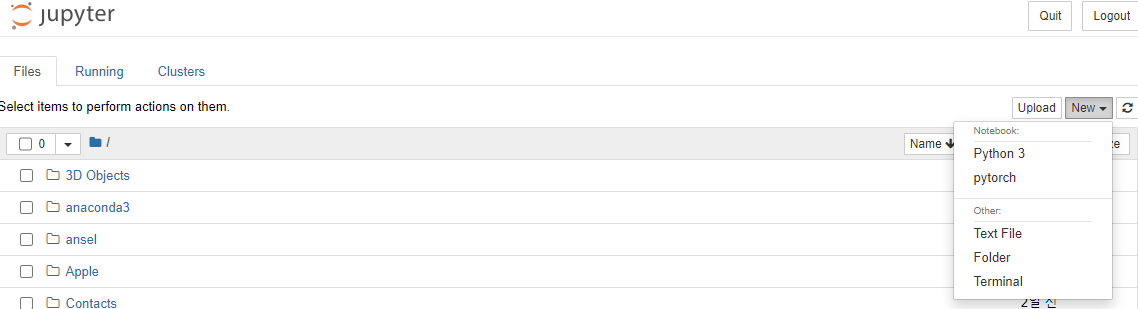

| Anaconda, Jupyter notebook 가상환경 만들기 (0) | 2020.06.15 |

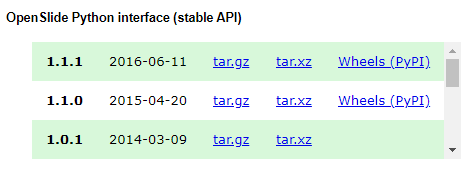

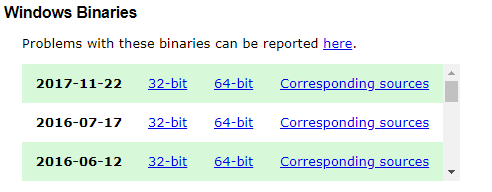

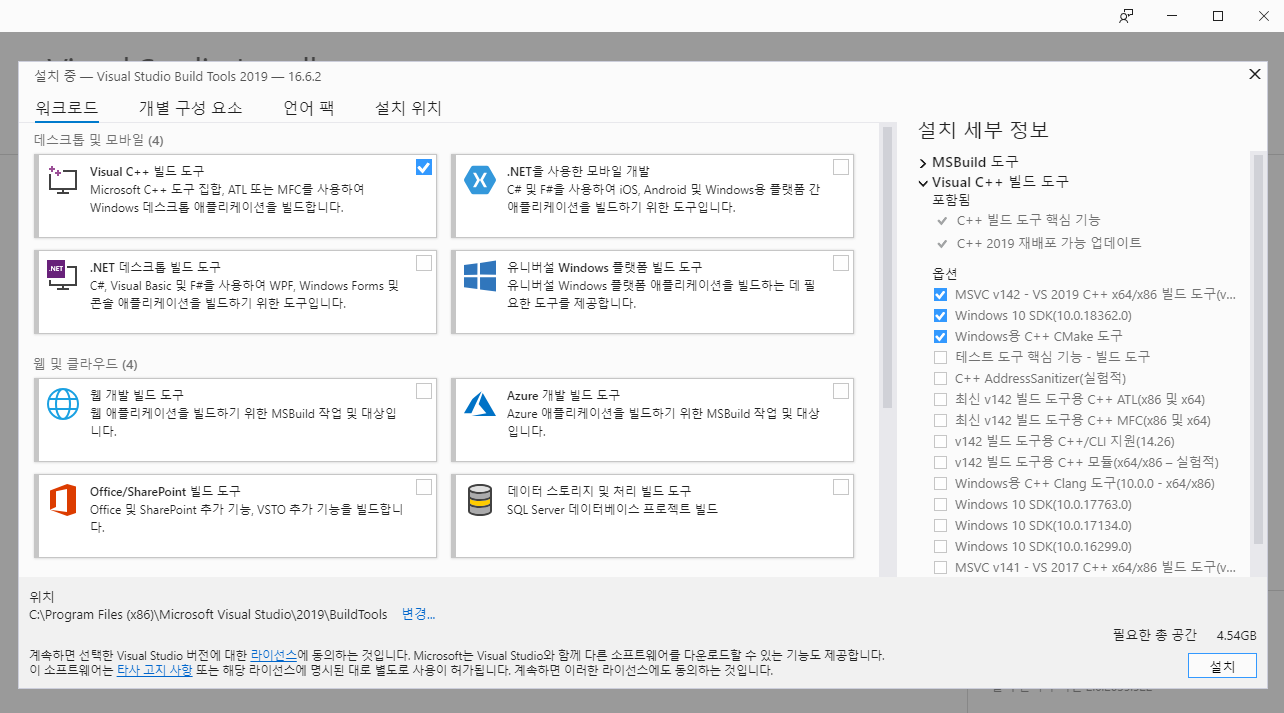

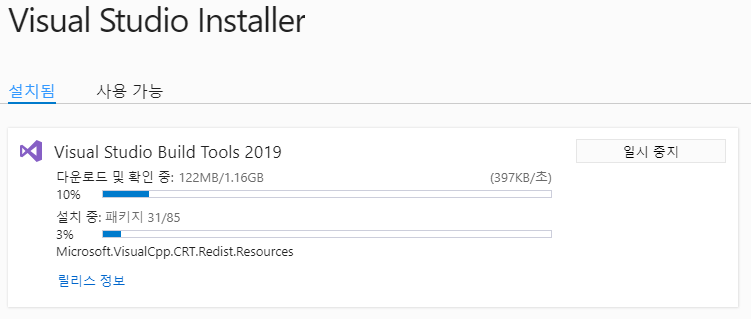

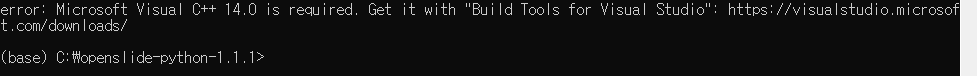

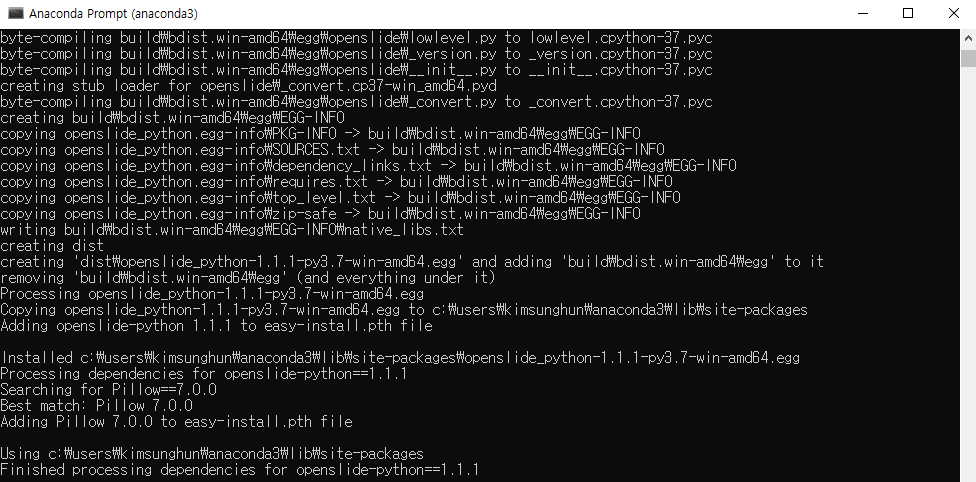

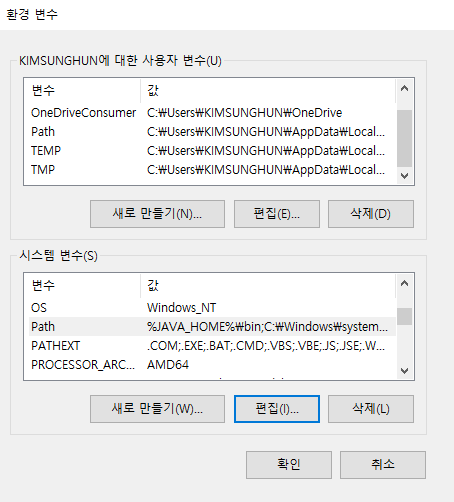

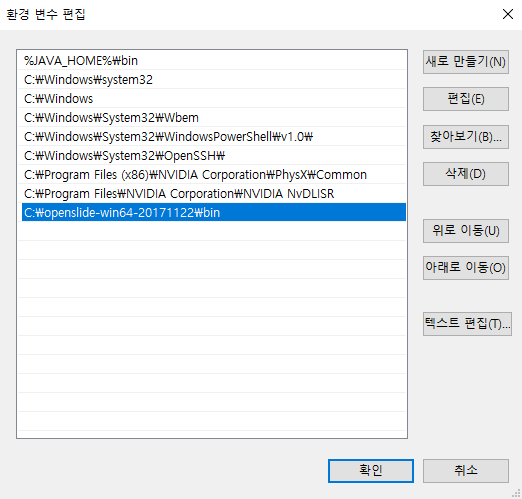

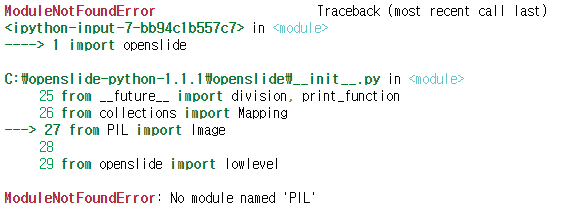

| python openslide 설치법 (0) | 2020.06.15 |